Positive Mobility

eMagDriverless vehicles, still running-in

For many years self-driving cars were confined to science fiction. Today they are a reality, offering us tantalising glimpses of seemingly limitless potential. And if the manufacturers, public authorities and businesses involved in transport, to a greater or lesser extent, are all committed to this revolution, the fact remains that the rise of driverless vehicles raises a great many questions. These may be social or legal relative to acceptability and safety-related issues, or economic relative to the suggested business models and uses. Here’s a round up of the current situation.

Whether ProPilot by Nissan, Autopilot by Tesla or Connected Pilot by DS Automobiles (PSA Peugeot-Citroën), semi-automated driver-assistance systems are increasingly commonplace in the passenger vehicle ecosystem. And the most advanced models such as the Tesla Model S or Audi A6 mean that progress in this field is already changing how we drive. These systems, however, remain several steps away from the promise of fully hands-off, mind-off driving.

Balancing benefits and risks

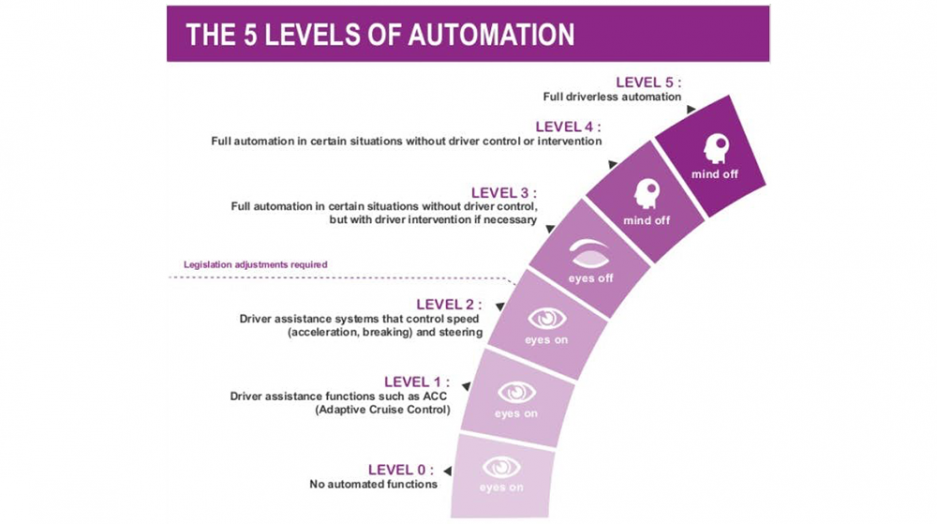

Most current systems are level 2 or 3 in terms of the five levels of automation established by the Society of Automotive Engineers (SAE).

Source: https://newatlas.com/peugeot-citroen-autonomous-car-paris-bordeaux/39738/#p367894

Fully driverless vehicles will not appear on the road before 2025-2030 at the earliest, because of the time needed for the technology to become sufficiently mature and to answer the non-technical issues it raises.

Consumer excitement about driverless vehicles is already rising:

- 52% of consumers say that driverless cars will be their preferred mode of transport by 2024;

- they see benefits in terms of fuel efficiency (73%), reduced emissions (71%) and saving time (50%);

- 56% say they would be willing to pay up to 20% more for a self-driving vehicle over a standard one.

But people are also anxious and uncertain about a number of aspects of tomorrow’s driverless mobility. Safety is the foremost concern in the wake of a number of recent accidents involving driverless vehicles. One of the most widely reported was the death of a pedestrian killed by an experimental self-driving Uber vehicle in Arizona in March 2018.

Raising questions and solving problems

One of the key challenges to driverless cars is acceptability, something heavily influenced by the safety assurances they can provide. And this applies as much to personal injury as to cyberhacking; driverless vehicles are connected vehicles and as such they are vulnerable to hacking. There are also questions surrounding liability and the regulatory regime applicable to these technologies. Alterations will be needed to existing legislation before any future mass production and deployment can happen.

A core treaty like the 1968 Vienna Convention on Road Traffic, for example, permits automated systems only if these can be controlled and deactivated by the driver. Situations falling under the scope of level 3 and higher on the scale of automation are not, as yet, allowed.

This is ultimately a debate about ethics and how to configure algorithms that will guide a vehicle facing the risk of a collision. This issue lies at the heart of the Moral Machine experiment, an online platform launched by a team of researchers from institutions including MIT, Harvard and the CNRS.

Fast-moving technology ecosystem

In purely technological terms the most advanced systems currently on the market provide level 3 autonomy, where the vehicle can take charge of some driving tasks but the driver must be ready to take the wheel at all times. The development of driverless vehicles remains dependent on joint efforts by a wide range of actors: vehicle manufacturers, component manufacturers, startups, government bodies, researchers, connectivity providers, etc.

In the case of passenger vehicles it is especially reliant on scaling up the infrastructure, an area where equipment operators and managers have a big role to play. In 2017 a driverless vehicle transited a motorway toll plaza under normal traffic conditions without any input from the driver thanks to the ability of vehicle and infrastructure to communicate with each other. This world-first came about thanks to a partnership between PSA and VINCI Autoroutes.

In 2018, France rolled out a dedicated national strategy designed to bolster and encourage the emergence of a driverless vehicle ecosystem.

| The French strategy to promote the development of autonomous vehicles, unveiled on 14 May 2018, sets out 10 priority actions, including:

· constructing an appropriate regulatory framework; · establishing a national testing programme, which in 2019 saw the launch of 16 trials as part of a call for experimental autonomous road-going vehicle projects covering vehicles for private use, public transport and freight; · preparations for infrastructure connectivity.

|

However, France is some way behind other countries with more long-established policy commitments in this area. According to a 2019 report from KPMG, France is 17th in terms of readiness. The report stresses that the most advanced markets need to ramp up investment in technologies and innovation, and that the countries leading the way in this field would gain from greater clarity concerning their policy positions.

Countries where driverless vehicles are most deeply embedded / Technologies & Innovation

- Israel

- Norway

- USA

- Germany

- Japan

Aside from the need to combine expertise, it is money that remains the most critical lever. Two major strategy alternatives are available to vehicle manufacturers faced with the financial challenges inherent to vehicles able to attain levels 4 and 5 of automation. One is to turn to a business model focused more on selling a service than a product; this is a path recently taken by Tesla with the unveiling of Robotaxi, which proposes that owners make their cars available for users of its ride-sharing app. The alternative is to pool the investment costs, a path taken at the start of the year by BMW and Daimler, and Honda has joined the Toyota-SoftBank alliance working to develop services that include autonomous driving.

The traditional car will still be with us for a while!